-

Posts

18230 -

Joined

-

Days Won

377

Posts posted by Coss

-

-

Not those evil Aussies though

http://englishnews.thaipbs.or.th/indonesia-waives-visa-requirements-for-45-countries

and Vietnam soon too....

http://www.ttrweekly.com/site/2015/06/vietnam-extends-visa-free-list/

-

-

Nice to see Brosnan in this type of role, he's getting better as he gets older.

-

Survivor 2015 - Milla Jojovich Pierce Brosnan, both very good in this, modern day explosions, intelligence people, well worth a watch.

-

Debt-ridden Thailand being sucked into whirlpool of deflation

Thanong Khanthong

BANGKOK: -- Disinflation - or negative inflation - has hit Thailand for the past five months in a row. In the first quarter of this year, inflation was minus-0.5 per cent. The situation worsened in April, with inflation at negative-1.04 per cent. In May the disinflation surged to -1.27 per cent, prompting growing concern as to whether deflation is waiting on the horizon.

While disinflation is a temporary phenomenon of price decline, deflation represents a general collapse in prices and demand, aggravated by a lack of fresh investment and a marked slowdown in the velocity of money (its speed of circulation).

Once an economy plunges into a deflationary spiral, it is extremely difficult to perk it up again. A dose of fiscal expansion and sharp rate cuts will have to be met with renewed confidence and fresh investment to create employment. The advanced economies - the United States, the UK, Japan and most recently Europe - have embarked on this policy of Keynesian spending and zero interest rates to pull themselves out of the severe slump, yet despite seven years of unorthodox methods a recovery is nowhere in sight.

Indeed, a recovery can never come under the current insurmountable level of indebtedness. Global debt has reached $200 trillion, or three times the size of the global GDP of $70 trillion.

The global economy can't grow with more debt. Without debt restructuring, any recovery is out of the question.

Most Thai economists agree that deflation is not on the table yet, as the marginal fall in prices, caused by weak oil and food prices, will hit rock bottom soon after the economic pickup.

"We expect headline inflation to bottom out and then pick up gradually from June onwards," Phatra Securities reported on Tuesday. "However, we expect that headline inflation will not turn positive until the fourth quarter of 2015."

Disinflation and deflation aside, Thailand is entering a dangerous period of economic slump and geopolitical risks. The downturn is caused by weak demand, both internally and externally. Household debt has reached Bt10.4 trillion, in a Thai economy whose total size is Bt13 trillion. Thai consumers no longer have much room to buy. To consume more they will have to further leverage their household balance sheet. They can't create more debt.

This has resulted in an overcapacity or oversupply situation in the

economy. Businesses do not want to invest further because they can't sell their goods or products. Banks are more reluctant to lend for fear of bad debts. Small and medium-scale enterprises are being hit hard by the lack of fresh credit and weak consumer demand.

Externally, the Thai export sector, which has been the engine of the Thai growth, is sputtering. The export sector has also registered shrinkage five months in a row, with figures for the first quarter of 2015 showing minus-4.3 per cent growth.

The explanation is either weak overseas demand or a lack of competitiveness in Thai industries. If overseas demand is the problem, there is nothing much we can do. If we cut the prices - by lowering the baht exchange rate - other countries can do the same, triggering a currency war. If the problem lies in exports' loss of competitiveness, then Thai industries have to take responsibility.

So what should be the appropriate policy response from Thai authorities? Government spending grew almost 30 per cent in the first quarter of this year, offering a degree of economic stimulus. But we all know that fiscal stimulus has its limitations. One can't expect the government to create a heavy debt burden year in and year out in order to perk up the economy. Japan and other welfare states have tried this medicine before and all ended up with unsustainable public debt. In the case of Japan, the government debt to GDP has reached a staggering 240 per cent. Creating more debt risks destroying the value of the yen, now hanging by a thread and on life support provided by the Bank of Japan's government bond-buying programme.

Then it comes to the efficacy of monetary policy. The Bank of Thailand acted as if it had blood in its eyes when it cut its benchmark rate twice in a row to 1.50 per cent. The banking authorities must have seen disturbing signs in the economy, prompting them to cut the rates in a hurry. First, they want to send out a signal that they are providing an accommodative environment to stimulate domestic demand and growth. Second, they want to encourage the banks to extend further credit, particularly to the SMEs. Third, they want to rely on exchange rate targeting to boost exports.

In macroeconomic management, we can't overdo both the fiscal expansion and the monetary stimulus. Government overspending will create debt burden for future generations. Besides, disbursements are not timely enough.

At the same time, monetary stimulus, if it is overcooked, discourages businesses, industry, households and the private sector in general from making appropriate adjustments to the actual prices.

For the Bank of Thailand's low interest rate policy carries a double-barrel effect: lowering the cost of borrowing and weakening the baht.

But we can see that the banks have not cut their borrowing rates to match the central bank's rate reduction. Thai banks' profit margins remain at a historic high compared to banks in other countries, with profits of Bt50 billion in the first quarter of this year. A quick calculation projects bank profits at Bt200 billion this year. Banks are fattening their pocketbooks at the expense of the general economy and Thai borrowers. That's why Bank of Thailand governor Prasarn Trairatvorakul was rather emotional when he found out that the banks had maintained their borrowing rates intact. That means Thai consumers are not benefiting from this round of rate cuts.

Now we come to the exchange rate targeting. The baht is losing value in a hurry under the Bank of Thailand's deliberate policy to weaken the currency. Last month alone, the baht weakened by 4 per cent, almost touching Bt34 to the dollar. Siam Commercial Bank recently predicted exchange rate targeting could drive the baht down to Bt35 before the end of the year.

Destroying currency value is a bad money policy, but, strangely enough, most central bankers have adopted it in earnest.

Weakening a country's currency might benefit the domestic export sector in the short term, but overall it harms the nation's purchasing power.

Inflation will strike back with a vengeance. Under good money policy, the value of the currency remains stable over time. This benefits not only grass-roots citizens but also the overall economy, because all the participants do not have to play catch-up with runaway inflation.

A low interest rate environment, coupled with a weakening currency, discourages the economy from making the necessary adjustments. Bad companies, which should have folded, remain on the scene to create future burden. They use resources that they don't deserve access to. A low interest rate policy also drives away savings. Capital accumulation gives way to speculative investment in the stock market or real estate. Retirees or pensioners earn nothing from their bank savings. They do not deserve this kind of punishment from bad money policy, in which they almost earn nothing from interest returns while at the same time the baht's value diminishes steadily and harms their purchasing power.

In the end, the way out for Thailand is a combination of appropriate doses of fiscal and monetary medicine that allow the economy to adjust at its own pace. Thailand has already fallen into a debt trap, with combined private and government debt to GDP reaching 130 per cent. This high debt level will have to be brought down via restructuring, because raising incomes to pay down the debt looks almost impossible now given the global outlook. The government can tax the rich more to help out the poor. The banks must make less profit. The Bank of Thailand must not be tempted into a monetary trap, which would risk plunging the country into a zero interest rate environment. By that time it would be too late to save the baht.

-

Firstly, please note the post earlier, entitled

"Defense Minister: Thailand will be able to have yellow card given by EU rescinded"

________________

Agriculture Min admits inability to end IUU fishing by deadline

BANGKOK, 5 June 2015 (NNT) – Minister of Agriculture and Cooperatives Petipong Pungbun Na Ayudhya has indicated a possibility that Thailand’s effort to eradicate illegal fishing will not yet be successful within the six-month deadline given by the European Union.

After Thailand was given a yellow card by the EU due to its failure to comply with the Regulation on Illegal, Unreported and Unregulated (IUU) Fishing, Mr Petipong affirmed the government has clearly demonstrated its determination to address the issue. Personally, he believes it is unlikely for Thailand to become completely free from the problem of IUU fishing in a matter of only six months as demanded by the EU. However, he insisted that the goal will eventually be achieved with the cooperation from all sectors.

At present, the minister sees the need for the government to beef up its control of fishing methods that can be harmful to the environment and make amendments to the existing fishery laws for higher effectiveness. He said the overall operational plan will also have to be improved in order to restore the EU’s confidence while anticipating more clarity on the plan within this month.

Regarding the management of fishery workers to prevent human trafficking, Mr Petipong conceded it is a difficult task despite the ministry’s cooperation with the Royal Thai Navy and the Immigration Bureau. According to him, the inspection of fishing vessels departing and arriving at the port is especially hard to manage while the shortage of workers on board experienced by some operators is another issue to be addressed.

Ahem

-

AFAIK most asian cell phone providers will load you with extra services like calling melodies and pink frilly emotions on an opt out basis, i.e. you have to tell them you don't want them.

Even with my limited language abilities I've found the best approach is to confront a pretty and nervous service girl at the phone companies offices and point at the offending service on the phone, whilst uttering "Mai Ow" (Thailand) or "Bor Ow" (Laos) this usually works and has the tangential result of flushing the nervous and pretty girl's complexion.

Hope this helps.

-

Ex Machina 2015 - quite good, notable for beautiful female lead and also a hot asian chick. Deals with AI and Turing test, for real (well movie real). Not quite as deep and meaningful as the makers no doubt think it is, but well worth a watch.

-

Then I'm not Madagascan, oh my, I'm so relieved

-

1

1

-

-

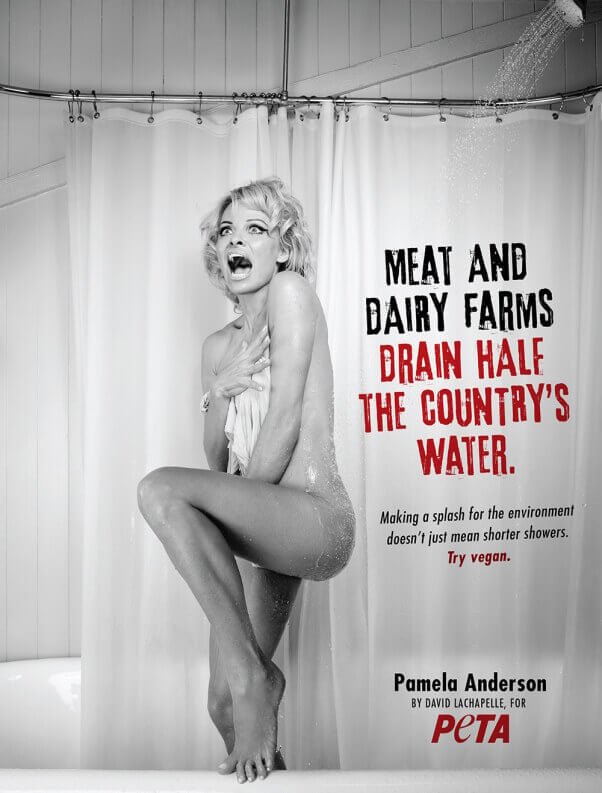

Actually, from the OP, if meat and dairy farms drain half the country's water, we should be grateful. The amount of rain we get here, if half of it wasn't being drained, we'd be flooded all the time.

-

on an unrelated note, apparently this one is 28-year-old reality TV star

famous for? being in the same family of fat girls who are famous for wanting to be famous

circle jerks

-

How do you know if someone's a Vegan? Don't worry, they'll tell you.

-

Another one, nearly like the other one

-

1

1

-

-

gratuitous pic

-

1

1

-

-

good bad or indifferent?

-

Modern thinking suggests they are all able to be rehabilitated. Though I'd bet a dollar or two, that the young'un who held up the human head, will do it again when he's a teenager and full of angst.

The tribalist in me says put them in the grinder and make fertiliser.

-

Kingsman The Secret Service 2014 - previously reviewed here. My take is - enjoyable, some nice music, a little 20 something-ish, nice exploding heads, if they do a sequel I'll look. Worth a watch.

-

On the other hand, I'm one who has found, the pricing high and attitude of a lot of places in LOS to be substandard compared to the old days.

But I have, found bliss, with a singular entity, and now can say, if I'd had this 25 years ago, I might have never ventured into a gogo bar.

Not that I'd avoid them now, I've been infected, you see.

-

1

1

-

-

The Dark Half 1993 - Quite a good thriller/horror, not zombies, not inane. Well worth a watch.

The Judge 2014 - reviewed here earlier I believe - potentially a very good movie - but ultimately worth a watch.

The Flowers Of War 2011 - Christian Bale in war-torn China with a bunch of orphans and ladies of the night - good - worth a watch.

-

Smart phones are also for middle aged or older men, who want to communicate effectively to goofy little Japanese, Korean and Thai girls with arses we kill for.

-

To get the ball rolling - 10,000-year-old Antarctic ice-shelf 'gone in five years'

http://www.nzherald.co.nz/world/news/article.cfm?c_id=2&objectid=11450770

Antarctica's Larsen B ice-shelf is on course to disintegrate completely within the next five years, according to a study by US space agency Nasa.

The 10,000-year-old ice-shelf, which partially collapsed in 2002, is "quickly weakening" and likely to "disintegrate completely" before the end of the decade, researchers have predicted, after observing warning signs including large developing cracks and faster-flowing tributary glaciers.

"These are warning signs that the remnant is disintegrating," said Ala Khazendar of Nasa's Jet Propulsion Laboratory in Pasadena, California. etc etc

___

We have to wait 5 years for this one, but I'll still be here to see...

-

I propose a thread of, then and now predictions. Or let's see if this is going to be true..

Examples may be - Arctic Ice Cap disappears completely predictions, but it hasn't. Or any topic at all, but it should be a prediction and whether or not it turns out to be true, or not.

-

Your telling me, I'm 55 and limited in various work fields.

I can do alot of the different jobs as they are required with my line of work.

But due to no college paper saying I took the courses for that line of work I'm s.o.l.

Same same, though I got lucky and landed a 'contract' for a short time, which is like saying "we want your work" but when they learn what is is I can do, they'll let me go...

-

Am surprised North Korea didn't make that list.

Difficulty getting citizenship implies that it can be gained. I would think that the Hidden Kingdom just outright bans it.

The Prediction Thread

in The board bar

Posted

Heres one on climate change http://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=11465003

NZ should expect more droughts.